When it comes to loan review, there are three key areas to help ensure a more effective process.

The organizational structure of the loan review process must reflect independence and objectivity.

It's imperative that FI senior management demonstrate commitment to a robust loan review program.

The scope must be defined in advance for a loan review to provide value and meaningful data.

This article is substantially updated from a 2013 blog post.

There will always be risks inherent in loan portfolios, and effective portfolio management and loan control functions are critical to the overall risk management function of banks and credit unions. The loan control function is typically spread over three functional areas within the institution: credit administration, audit, and loan review. When it comes to loan review, there are three key items to help make the process more effective.

Without question, the most important key to an effective loan review program is ensuring its independence and objectivity, and the organizational structure must reflect this independence.

The primary consideration for organizing the loan review function is determining whether the function will be performed by an internal department or completed externally by a third party, such as a loan review or consulting firm. Institutions could benefit from a hybrid loan review approach, combining an internal loan review process with a periodic external review. In a hybrid approach, loan review consultants work alongside an institution’s internal program to provide a risk assessment with an outside perspective, along with an evaluation of overall credit administration. Regardless of how the loan review function is organized, it’s paramount that the loan review function remains objective.

The review of loan risk ratings and grades provides a clear example of why objectivity is so critical to an effective review process. Banks are required by regulators to have formal risk rating policies in place to determine how ratings are assigned. These grades are one of the primary measures in stratifying the loan portfolio, and they have a direct impact on loan pricing and the reserve for loan loss.

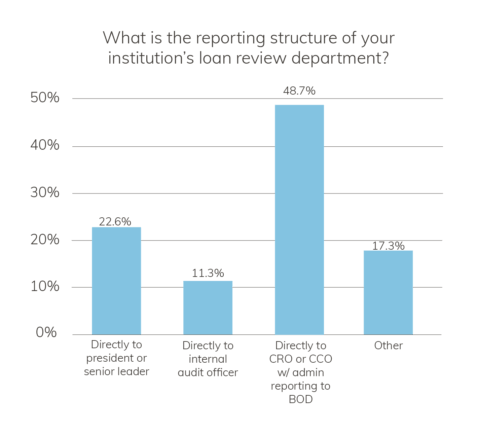

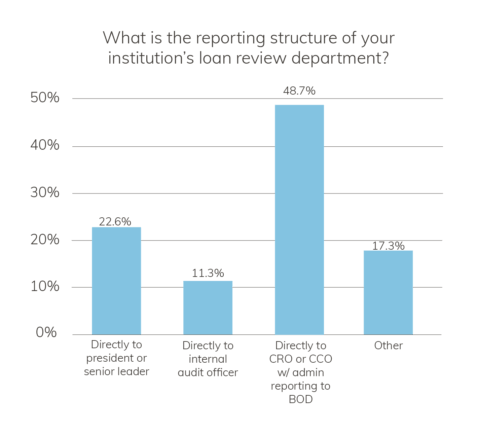

In a recent Abrigo survey, nearly half of survey respondents said that their institution’s loan review department reports directly to the Chief Risk Officer or Chief Credit Officer, or the board of directors. Meanwhile, 23% of respondents report directly to the President or Senior Lender, and just 11% report directly to internal Audit Officers.