Navigating certified payroll can feel like traversing a construction site with many hidden pitfalls. The payroll forms , reports, and filing processes can be time-consuming for contractors and subcontractors.

You may need to submit weekly payroll reports if your business works on federally-funded projects. It’s one more thing you need to take care of as a business owner.

Here’s a breakdown of what you need to know about certified payroll, including payroll reports and how to file:

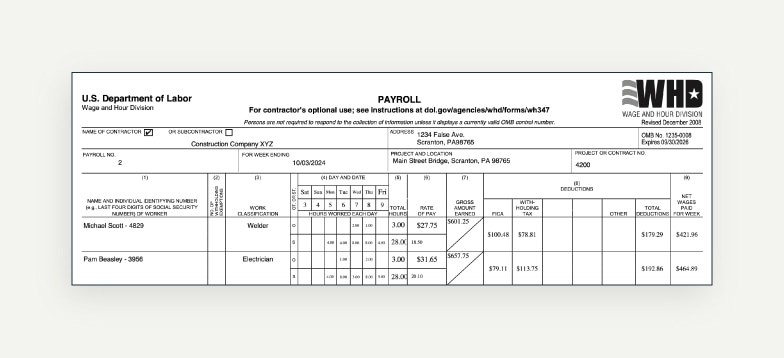

Certified payroll is a federal payroll report that government contractors must submit weekly using Form WH-347 .

The form lists every employee, their wages, their benefits, the type of work they did, and the hours worked. It also shows withholdings and gross wages. You must file the report with the US Department of Labor each week, even if the work temporarily halts.

Certified payroll reports confirm you are paying employees a prevailing wage as part of the Davis-Bacon and Related Acts.

FYI: Contractors or subcontractors with a contract of over $2,000 to complete work on federally-funded construction projects typically have to do certified payroll.

Certified payroll is a requirement of the Davis-Bacon and Related Acts , which ensures workers on public works projects get fair compensation. These laws apply to the construction or repair of public buildings or public works projects. The term “public works” refers to structures built for public use, such as schools and highways.

If your business works on a federal contract of over $2,000, the Davis-Bacon Act requires that you complete certified payroll reports.

To ensure business owners who work on federal construction projects compensate workers fairly, they must pay their workers a specific pay rate. Their gross pay must be no less than the local prevailing wage rates for corresponding work on similar projects in the area.

You must also comply with state prevailing wage rates. If the state rate is higher than the federal rate, you must pay the state’s higher rate. Your state can verify whether you must comply with a state wage requirement.

The Department of Labor can help you find your wage determination . It lists the wage rates and fringe benefit rates for each labor category. Use the filters on the site to find the wage rates for a particular project.

If you submit certified payroll reports via Form WH-347, you’ll need to include basic payroll data, like each worker’s name, Social Security number, and tax withholding information.

Like most federal forms, Form WH-347 can be confusing. Let’s look at the two key sections of the form.

Start by entering your information at the top of the form:

Then move on to the numbered columns on the form:

Now review the certified payroll example below to see what Form WH-347 looks like filled out:

After completing the first page of Form WH-347, don’t forget the second page. The second page is where you “certify” your report.

It includes a statement of compliance that indicates the payroll forms are correct and complete. It asserts the pay for each employee meets the proper prevailing wage .

Some contractors and payroll providers think they must be a Certified Payroll Professional (CPP) to complete and submit a certified payroll report. That’s not true. Any contractor provider can complete and submit a certified payroll report.

A company owner or payroll manager signs the statement of compliance. In doing so, they understand that the willful falsification of any payroll information may subject the contractor or subcontractor to civil or criminal prosecution.

Anyone can complete a certified payroll report. The biggest job is gathering the data and completing the form.

It should take less than an hour to gather and compile the information for eight employees on a single report. But you could spend hours just collecting, reviewing, and confirming your payroll data. That’s in addition to generating paychecks and completing a certified payroll report.

This work becomes more time-consuming; the more employees you have, the more jobs you work on. It’s also highly error-prone if you are creating these payroll reports manually.

Better organization makes it easier to fill out and submit your certified payroll reports. Here are a few tips to stay on top of this important task:

Failing to pay the prevailing wage can be costly, as you may have to pay back wages to employees. Plus, not meeting the requirements of the Davis-Bacon Act can lead to contract termination.

Managing payroll is a necessary part of construction accounting for contractors. However, creating and submitting a certified payroll report is an added step for those who work on construction projects.

Automated payroll services and software like QuickBooks Payroll can help you run payroll faster and more accurately. You can also use built-in payroll tools to create a certified payroll report.

A certified payroll specialist (CPS) must pass the Certified Payroll Professional (CPP) exam and be accredited by the American Payroll Association (APA). Passing the exam shows they have the necessary knowledge and experience to handle certain payroll types like certified payroll.

What is the prevailing wage law?The prevailing wage is the average or majority hourly rate a contractor pays. The pay rate of the majority of workers, laborers, and mechanics in the largest city of a given county determines the prevailing wage.

What type of work do you include in the prevailing wage?The prevailing wage law specifies several job classifications, including carpenters, electricians, plumbers, ironworkers, flaggers, craftsmen, welders, concrete finishers, longshoremen, power equipment operators, and helpers.

Who is exempt from certified payroll?Certified payroll does not apply to salaried workers in executive, administrative, or professional positions. Certified payroll is for on-site workers whose primary duties include manual and physical labor.

Recommended for you

Payroll records: What are they and why do you need them?

January 22, 2020

Payroll forms every business owner should have

What business owners need to know about prevailing wages

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.